Jurupa Valley might not be the first city that comes to mind when you think about investing in Southern California real estate but that’s exactly why more and more investors are paying attention. Tucked into the northwestern corner of Riverside County, Jurupa Valley sits right next to high-demand cities like Eastvale, Ontario, and Riverside. It’s a strategic location and close enough to benefit from the Inland Empire’s booming job market, but far enough to offer better affordability, larger lot sizes, and more investor-friendly zoning options.

Why Jurupa Valley Is Gaining Investor Attention

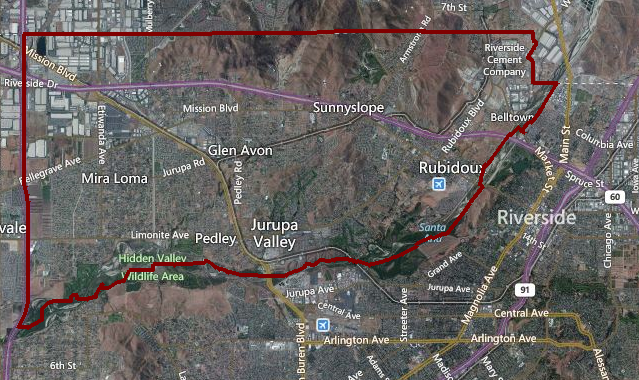

Jurupa Valley wasn’t even an incorporated city until 2011. Before that, it was made up of several distinct unincorporated communities like Mira Loma, Glen Avon, Pedley, and Rubidoux. That history gives the area a unique mix of property types: you’ll find everything from suburban single-family developments to rural homes with horse zoning and agricultural land. For investors, this means options. Whether you’re looking for a traditional rental, a house with ADU potential, or a property that can be upgraded and repositioned, Jurupa Valley offers flexibility that’s hard to find elsewhere in the region.

The demand is there, too. Jurupa Valley is surrounded by one of the most important industrial corridors in the western United States. Thousands of logistics and warehouse employees commute daily through the 60 and 15 freeway corridors. These workers are looking for housing that’s affordable, convenient, and family-friendly and Jurupa Valley delivers on all three.

In short, this is a market that’s still evolving. It hasn’t been overrun by investors yet. It’s affordable, accessible, and full of untapped potential especially for investors who understand how to add value and are willing to do the neighborhood-by-neighborhood research that Jurupa Valley requires. As cities like Corona and Eastvale continue to price out working families, Jurupa Valley is quietly becoming a prime target for the next wave of Inland Empire real estate investment.

Jurupa Valley’s Real Estate Market in 2025: Prices, Rents, and Trends

As of 2025, Jurupa Valley presents an intriguing blend of affordability and upside potential for real estate investors. With an average home price of $681,000, Jurupa Valley remains more affordable than nearby cities like Eastvale or Corona, which often see prices well above $750,000. And despite slower statewide appreciation, Jurupa Valley managed to post 1.6% growth in property values over the past 12 months, slightly outperforming other parts of Riverside County.

Rental demand is strong and steadily rising. The median monthly rent for a property in Jurupa Valley now sits at $2,000, offering a competitive price point for tenants seeking value in the Inland Empire. Rent prices scale with property size, with 3-bedroom homes commanding about $3,000 per month, and 2-bedrooms averaging $2,200. Even studio and 1-bedroom units, less common in this market, rent for $1,300 and $1,530, respectively.

From a demographic standpoint, the average household income is a respectable $96,200, and the median age is 33.8 years, younger than the state average. This points to a largely working-class, family-oriented tenant base that values space, affordability, and proximity to job centers. In fact, around 30% of Jurupa Valley homes are rentals, indicating a solid, stable tenant pool for landlords.

Jurupa Valley’s housing market hasn’t experienced the rapid run-ups seen in Los Angeles or Orange County, but that’s not necessarily a bad thing. The city’s growth has been more measured and more sustainable. Investors looking for a slow-and-steady market with solid cash-flow fundamentals will find plenty of opportunity here. With rents rising, home prices still relatively accessible, and strong demand from blue-collar tenants in the logistics and construction sectors, Jurupa Valley offers a compelling price-to-rent ratio and the kind of long-term stability that appeals to income-focused investors.

While you won’t find speculative appreciation here, what you will find is a market with room to grow and properties that can generate consistent rental income from day one.

Economic Drivers and Who Lives Here: Tenant Demographics

Jurupa Valley’s economy is shaped by its location at the heart of the Inland Empire’s industrial engine. Sitting just north of the 60 freeway and intersected by the 15, the city is surrounded by one of the largest warehouse and logistics corridors in the country. Every day, thousands of workers commute into and out of the area to support Southern California’s distribution network, servicing companies like Amazon, UPS, Walmart, and Target. This logistics infrastructure is the backbone of Jurupa Valley’s tenant demand.

Most renters in Jurupa Valley are working-class families and blue-collar professionals. The median household income is just over $96,000, which is strong for the Inland Empire and reflects dual-income households employed in construction, manufacturing, shipping, and public sector jobs. Many tenants commute to nearby cities like Ontario, Fontana, Riverside, and Corona, taking advantage of Jurupa Valley’s strategic freeway access to save on housing costs.

Jurupa Valley also attracts multigenerational families and long-term tenants due to its larger lot sizes, flexible zoning, and more rural feel in certain neighborhoods. These tenants often prefer single-family homes with extra space for relatives or potential ADUs. The median age of 33.8 years suggests a young, family-oriented population that’s still growing, and that means long-term demand for housing will remain strong.

You won’t find a major university, research hospital, or high-tech hub in Jurupa Valley. What you will find is a steady, blue-collar tenant base that values space, stability, and affordability. Renters here aren’t chasing luxury—they’re looking for functional homes near their jobs, with room for families, pets, and sometimes even horses. Investors who understand this demographic and cater to it, clean, well-maintained homes at fair prices, will find consistent occupancy and dependable rental income.

This is not a speculative tenant pool. These are hardworking residents with deep ties to the region and a practical need for housing close to work and family. For landlords, that means fewer turnovers, lower vacancy rates, and tenants who are more likely to stay put if treated well.

Zoning Flexibility and Value-Add Potential

One of Jurupa Valley’s biggest advantages for investors is its flexible land use and zoning. Unlike nearby cities like Eastvale or Ontario, where suburban planning and strict municipal codes can limit what you can do with a property, Jurupa Valley still has large pockets of unincorporated or semi-rural areas that allow for more creative investment strategies. Here, zoning codes are more accommodating, and larger lots are common. That opens the door to real estate plays that simply aren’t possible in more tightly controlled jurisdictions.

Many homes in Jurupa Valley are on lots that exceed 7,000 or even 10,000 square feet. A significant portion are zoned for agricultural or equestrian use, meaning investors can add structures like barns, workshops, or stables or even reconfigure the land to accommodate an accessory dwelling unit (ADU) or junior ADU. In some cases, investors are converting detached garages into rental units, building second homes in the backyard, or subdividing larger parcels for multiple income-producing units.

For buy-and-hold investors, that means more rental income potential per property. For flippers or developers, it creates exit strategies that include ADU conversions, rental increases after value-add renovations, or parcel splits. These types of improvements are much harder or outright prohibited in cities with modern tract housing and tight planning restrictions.

There’s also value to be found in under-improved or older housing stock. Because some parts of Jurupa Valley were originally rural and remained unincorporated for decades, many homes are outdated, poorly maintained, or cosmetically neglected. That creates an opportunity for investors who are willing to roll up their sleeves. Basic renovations, like new flooring, kitchens, bathrooms, or HVAC, can significantly increase both property value and monthly rent.

In short, Jurupa Valley is a value-add investor’s playground. Whether you’re interested in buying to rent, adding units, or improving properties for resale, the city offers the land size, zoning flexibility, and lack of bureaucratic red tape that makes creative investing not just possible but profitable.

Neighborhood Diversity and Why Local Knowledge Matters

One of the most important things to understand about Jurupa Valley is that it’s not a single cohesive community—it’s a patchwork of distinct neighborhoods, each with its own history, feel, and level of investment potential. This is a city made up of former unincorporated areas like Mira Loma, Glen Avon, Rubidoux, Pedley, and Sunnyslope. Because of that, neighborhood quality can vary dramatically within just a few blocks. Some areas are stable and improving; others are still in transition. This diversity can be both a strength and a weakness for investors.

On the upside, it creates more opportunities to find underpriced properties in improving areas. Savvy investors who take the time to study each submarket can identify pockets of growth, city infrastructure improvements, or nearby developments that could boost property values over time. For example, certain parts of Mira Loma and Pedley are seeing spillover interest from Eastvale, with new builds and renovations pushing the area upward. Likewise, homes near the 15 and 60 freeway interchanges tend to see higher demand from commuters.

But this diversity also comes with risk. Some parts of Jurupa Valley, especially near Rubidoux or older corridors along Mission Boulevard, can feel neglected or semi-rural, with deferred maintenance, inconsistent city services, and higher crime rates. Investors who skip the due diligence phase and rely only on citywide data may find themselves in neighborhoods that underperform on rent, appreciation, or tenant retention.

Jurupa Valley lacks the uniform feel of a master-planned city. It doesn’t have neatly organized subdivisions with matching homes and centralized amenities. Instead, you might find a remodeled single-family home next to a mobile home, a horse property, or a vacant lot. That variability makes property selection critical—and means boots-on-the-ground research is more important here than almost anywhere else in the Inland Empire.

The bottom line? Jurupa Valley rewards investors who dig deep. Spend time driving the neighborhoods, talking to locals, and reviewing zoning maps and development plans. By investing based on hyper-local insight—not just general assumptions—you can avoid problem areas and find long-term value others might overlook.

Every real estate market has strengths and weaknesses, and Jurupa Valley is no exception. While it offers a unique set of advantages for savvy investors, especially those seeking affordability, flexibility, and long-term rental income, it also comes with a few risks that require careful management. Below is a balanced breakdown of the core pros and cons of investing in Jurupa Valley real estate:

The Pros

Lower Purchase Prices Than Neighboring Cities

Compared to Corona or Eastvale, Jurupa Valley offers lower entry prices for larger homes and parcels. With an average home price of $681,000, investors can often find properties here for $50K to $100K less than similar listings just a few miles away, while still tapping into the same regional job market and tenant demand.Zoning Flexibility and Larger Lots

Jurupa Valley is one of the few cities in the region where you’ll routinely find properties zoned for horses, agriculture, or multiple units. Whether you're looking to build an ADU, convert a garage, or even subdivide a parcel, the opportunities here are far greater than in cities with tighter zoning codes.High Rental Demand from the Blue-Collar Workforce

The city’s proximity to major logistics hubs, construction sites, and distribution centers creates a steady demand for rental housing, especially from working families, tradespeople, and warehouse employees. These tenants are typically looking for well-priced, spacious homes near freeways and job centers.Strategic Inland Empire Location

Jurupa Valley’s location between Riverside, Eastvale, Ontario, and Fontana makes it a commuter-friendly option for a wide range of tenants. It sits directly along the 60 and 15 freeway corridors, major transportation routes for both regional workers and the logistics industry.Value-Add Opportunities

Jurupa Valley’s mix of older homes, flexible zoning, and larger lot sizes creates a wide range of value-add options for investors. Renovating an outdated property, converting an outbuilding into a rental, or adding an ADU can all significantly boost cash flow and long-term appreciation potential.

The Cons

Inconsistent Neighborhood Conditions

Because Jurupa Valley was formed from several formerly unincorporated communities, neighborhood quality is extremely inconsistent. Some streets are well-maintained and improving; others may still feel neglected or transitional. Hyper-local due diligence is essential.Aging Infrastructure

Jurupa Valley lags behind nearby cities when it comes to public amenities, sidewalks, roads, and utilities. Investors should account for potential deferred maintenance—not just on the property itself, but on city infrastructure that can affect tenant satisfaction and resale value.Limited Civic Amenities

Unlike newer cities with master-planned parks, shopping centers, and entertainment zones, Jurupa Valley has fewer built-in amenities. This can make some neighborhoods feel less desirable, especially to younger or higher-income tenants.Some Areas with Higher Crime Rates

Certain neighborhoods, particularly older or more industrial zones, do experience higher rates of property crime and code enforcement issues. As with any city, location matters. A smart investment in Mira Loma could outperform a poor decision in Rubidoux.Less Predictable Appreciation

Because of the city’s mixed development history and patchwork zoning, appreciation trends in Jurupa Valley are less predictable than in more homogenous cities like Eastvale. While prices are rising, the pace and consistency vary by neighborhood.

Overall Investment Grade: B

Jurupa Valley earns a solid B rating as a real estate investment market. It’s not a fast-flip environment or a luxury hotspot—but for long-term, yield-focused investors, it offers strong fundamentals. Affordable entry prices, steady rental demand, and zoning flexibility create upside potential—especially for those who know how to navigate its diverse submarkets.

Who Should Invest in Jurupa Valley? (Investor Profiles)

Jurupa Valley isn’t for everyone but for the right type of investor, it can be a hidden gem. Unlike cookie-cutter master-planned communities or ultra-competitive luxury markets, this is a city where creativity, patience, and a long-term mindset pay off. Here’s who is best positioned to succeed in Jurupa Valley’s unique real estate environment:

Buy-and-Hold Rental Investors

If your strategy revolves around long-term cash flow and equity growth, Jurupa Valley offers solid fundamentals. The tenant pool primarily consists of blue-collar families and workers in the logistics, construction, and service industries, and is stable and consistent. Properties that offer 3+ bedrooms, large yards, and garage parking are especially in demand. With relatively low prices compared to nearby cities and strong rental demand, this is a market where buy-and-hold investors can achieve positive cash flow from day one, something that’s getting harder to do in Southern California.Value-Add Renovators

Jurupa Valley is ideal for investors who want to improve a property and increase its income potential. Many homes here are older and may be outdated or poorly maintained. Cosmetic remodels such as flooring, kitchens, and HVAC updates can significantly raise both market value and monthly rent. Investors who understand construction costs and know how to manage light rehabs stand to gain immediate equity and stronger returns.ADU and Multi-Unit Builders

Because of the city’s flexible zoning and larger lot sizes, Jurupa Valley presents rare opportunities to build accessory dwelling units (ADUs) or convert existing structures into additional rental units. This strategy is especially attractive for investors looking to boost ROI without purchasing additional properties. In some areas, you may even be able to pursue parcel splits or multi-unit development, subject to local zoning and permitting.1031 Exchange Investors

For out-of-area owners looking to trade out of a high-cost, low-yield property, Jurupa Valley provides an attractive landing spot. A 1031 Exchange into this market can allow investors to trade one high-value property for two or three cash-flowing homes, while still staying within California. Jurupa Valley’s affordability combined with Inland Empire demand makes it one of the last places where this type of exchange still pencils out well.Out-of-State or Remote Landlords (With Local Support)

While local knowledge is important in Jurupa Valley, remote investors can still succeed if they partner with a trusted local property manager. Since the area has hyper-local dynamics and zoning nuances, trying to manage from afar without boots on the ground can lead to costly mistakes. But for those who work with a team familiar with the area, out-of-state investing here can generate reliable passive income with a relatively low entry point.

Jurupa Valley isn’t a hands-off investment but for landlords and real estate investors who want affordability, flexibility, and long-term upside in Southern California, it might be one of the best-kept secrets in the Inland Empire.

Is Jurupa Valley a Smart Investment in 2025?

Jurupa Valley may not have the polish of Irvine or the name recognition of Riverside, but that’s exactly why it’s starting to attract serious investor attention. In a Southern California market where affordability is shrinking and returns are tightening, Jurupa Valley stands out as one of the last cities offering real upside if you know where to look.

With lower purchase prices, strong rental demand, and flexible zoning that encourages value-add strategies, this city offers the rare ability to generate positive cash flow in a region dominated by break-even deals. Investors who are willing to do their homework, explore neighborhood differences, and think long-term can find significant opportunity here.

That said, Jurupa Valley is not a “set it and forget it” market. It requires on-the-ground insight, careful due diligence, and a clear investment plan. The city’s patchwork development, inconsistent infrastructure, and zoning complexity mean you can’t rely on surface-level data or online listings. Partnering with a knowledgeable local team—whether that’s a real estate agent, contractor, or property manager—can be the difference between a mediocre outcome and a high-performing asset.

For many investors, Jurupa Valley is the middle ground between the ultra-competitive coastal cities and the more speculative outlying desert markets. It’s affordable but still close to jobs. It’s diverse but still growing. It’s overlooked but that’s what creates the opportunity.

Key Takeaways

Median home price in 2025 is $681,000, offering affordability compared to Eastvale or Corona.

Rental demand remains strong due to proximity to logistics hubs, job centers, and major freeways.

Zoning is flexible, with large lots, ADU potential, and mixed-use parcels offering creative value-add options.

Neighborhood quality varies widely—hyper-local knowledge is essential to avoid underperforming areas.

Best suited for long-term investors, value-add buyers, and 1031 exchangers seeking stable cash flow.

Jurupa Valley earns a solid B rating as an investment market: not perfect, but full of upside for informed investors.

If you’re thinking about investing in Jurupa Valley—or already own a rental here and want help maximizing returns—PMI Riverside can help. Our team understands the unique character of each neighborhood, and we know how to turn the right property into a high-performing asset. Let’s talk.